A growing number of Brits are making the transition to location independence. This transition often comes with tax consequences and in this article, I explain what they are. I also cover how UK taxation works for non-residents, businesses and more.

Tax residency

The UK is a residential taxation country, this means that tax residents pay UK tax on their worldwide income while non-residents only pay UK taxes on their UK income. There is a caveat, however, in that it is possible to be a UK tax resident while deemed non-domiciled. See my UK non-dom guide for more details on this status.

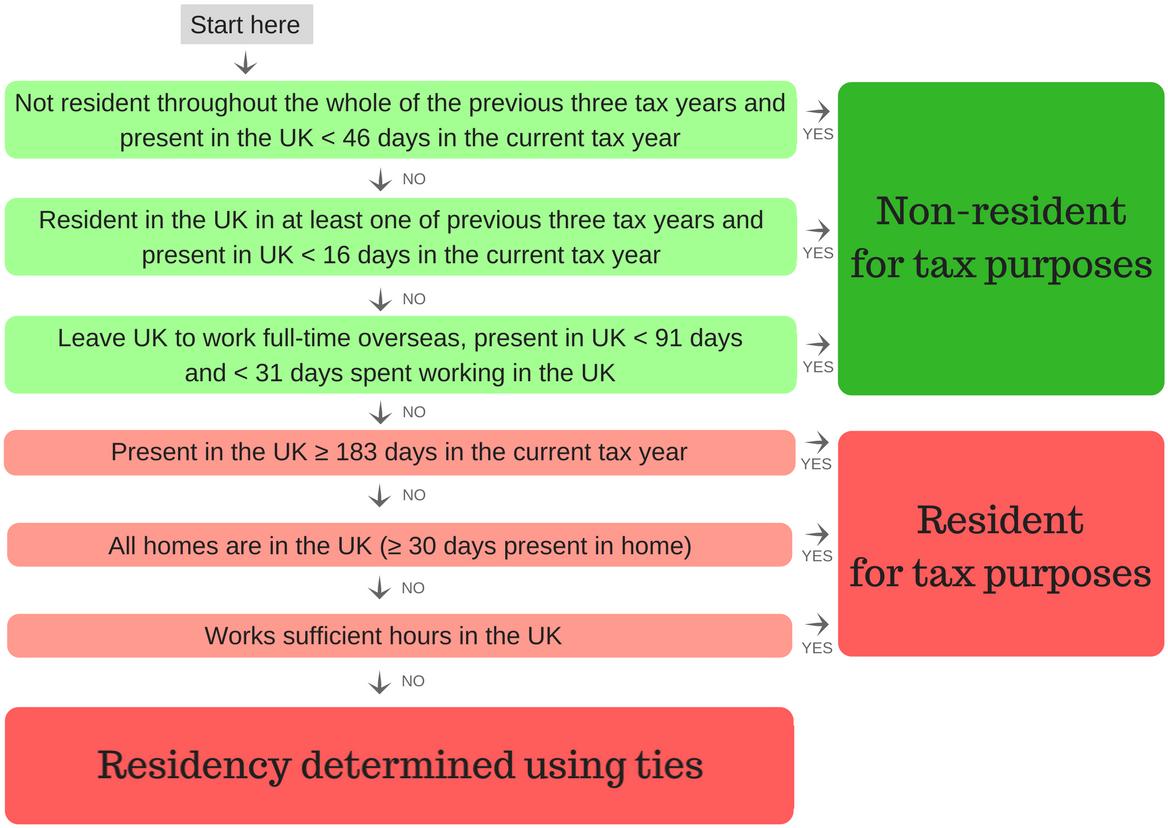

Unlike most countries, the UK uses a very straightforward residency test to determine whether an individual qualifies as a tax resident or not.

If you qualify as a UK tax resident, you will have to pay UK taxes on your worldwide income. For regular income (employment, sole trader etc), rates are progressive and range from 20% on income up to ~50000 GBP all the way to 45% on income above ~150000 GBP. The first ~13000 GBP is tax-free. Capital gains are taxed at a rate determined by your taxable income, see this page for more details. The UK has no wealth tax and no capital duty. It has a stamp duty (0.5%), an estate tax (referred to as inheritance tax, 40% above 325000 GBP) and a social security tax (2% to 13.8%). Most UK councils also charge a council tax. The tax year starts on the 6th of April and ends on the 5th of April of the following year. If a tax return needs to be filed, it must be filed before the 31st of October if filing via the post or the 31st of January if filing online.

If you are deemed a non-resident of the UK for tax purposes, or if you are a tax resident but qualify for non-dom status, you will have to pay UK tax on your UK sourced income and in certain cases, foreign sourced income you remit to the UK. The rates are the same as for tax residents, except that non-residents do not have a tax-free allowance.

Do note that income source usually refers to the location where work is performed, not where your employer, clients etc are located. See my article on foreign sourced income for more details.

Leaving the UK

Leaving the UK for tax purposes can result in significant tax savings, in some cases it may even result in the complete elimination of personal taxation.

The UK has no exit tax, and does not impose penalties on residents leaving. Leaving will also have no impact on your ability to manage / own a UK company.

If you were employed before leaving the UK (via PAYE) and received no other income, you will have to file form P85 (along with form P45, which you will obtain from your employer) after leaving. The form not only ensures that your status is correctly updated with HMRC but it also allows you to claim a tax refund if you are due one.

If you were self employed or received any reportable income for the year during which you left the UK, you will have to file a Self Assessment return. It must include the general pages (SA100), the residence pages (SA109) and any other relevant pages (partnership, rental income, self employment etc).

In any cases, there is no approval to seek from HMRC. Tax residency in the UK is a matter of fact, you either are a tax resident or you are not (see the flowchart above to determine your status).

You should also note that you may be liable to UK capital gains tax if you return to the UK within five years of leaving, and disposed of UK assets during your absence. The HS278 guide covers this in detail but in short, this rule is there to prevent UK residents from moving to a tax haven, liquidating all their investments (including UK stocks, ETFs etc) tax-free and then moving back the following year.

Taxation for non-residents

If you qualify as a non-resident of the UK for tax purposes and receive no UK income whatsoever, you will have no tax liability in the UK and no filing obligations. In other words, you will be completely free from UK bureaucracy. Do note that if you are a partner in a UK partnership, including an LLP, you will have to file a Self Assessment return even if you received no UK income.

If you do receive UK income, you will likely have a tax liability in the UK and will, in most cases, have filing obligations. Unless all tax owed was withheld at the source, you will have to file a Self Assessment return with HMRC. Your return will have to include the relevant pages for the type of income you received. Do note that there is no withholding tax on dividends received from UK companies and no reporting for those. Non-residents are also exempt from capital gains tax on the disposition of UK assets, except for real estate and land.

Business taxation

I have written guides specific to the UK LLP and the UK LTD. They cover how taxation works for these entities, their owners as well as how to register them, open bank accounts, payment processing accounts and more.

Foreign registered businesses operating in the UK are generally liable to UK corporation tax, regardless of their country of registration. See my place of management rules guide for more details.